Inflation continues to make headline news. The UK’s consumer price index is flirting with double digits, while the retail price index hit 12.3% in August. So, here are two stocks I’m looking to buy for my portfolio that I think could be inflation-resistant.

The Veblen Effect

Most companies tend to suffer during times of high inflation. This is because firms have to raise prices to combat rising costs. As a result, consumer demand drops as spending power takes a hit. However, certain companies are an exception to this norm. This is known as the Veblen effect.

It takes place when consumers buy more expensive products even though similar, lower-priced substitutes are available. This is mainly due to the belief that higher price equates to higher quality. Consequently, the share prices of such companies tend to remain robust and outperform major indexes during these times.

Should you invest £1,000 in Burberry Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Burberry Group Plc made the list?

Smoking hot

First of my list of stocks to buy is Imperial Brands (LSE: IMB). Up 13% against the FTSE 100‘s 7% decline, Imperial shares certainly look lucrative to me. While tobacco is a sunset industry, Imperial has managed to offer a range of ‘luxury’ lines through a number of its brands to offset its decline. These include the likes of JPS, Davidoff, and Gauloises, which have the potential to continue gaining market share in the premium space.

This has resulted in Credit Suisse and UBS giving Imperial shares ‘buy’ ratings. Additionally, the stock has seen an upgrade to its price target, from £23 to £25.50. This is an approximate 40% upside to its current share price, including dividends.

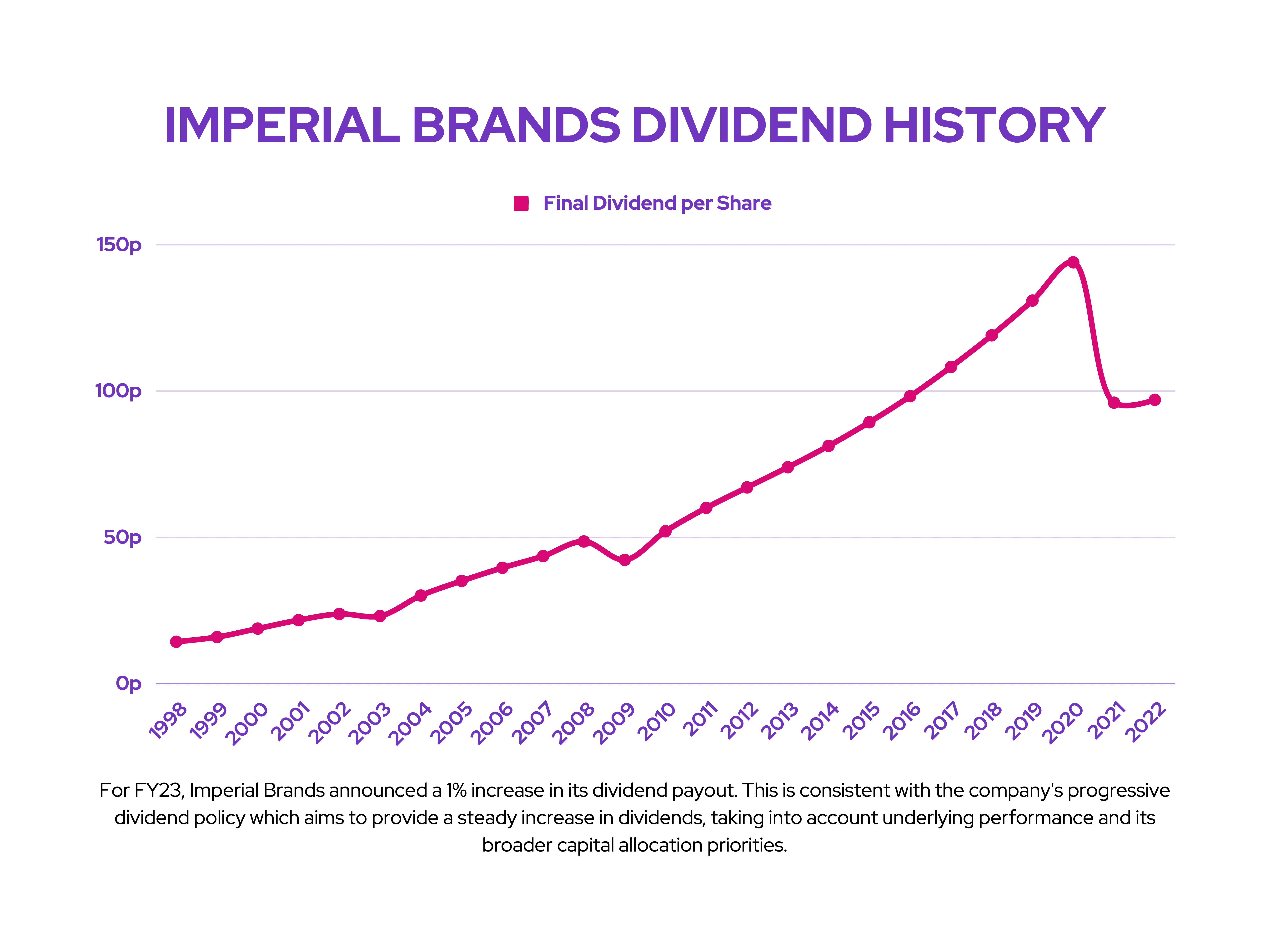

Although the state of Imperial’s balance sheet leaves much to be desired, its dividends are what cause investors to stick around. Analysts are expecting a 2% upgrade on the company’s next declaration date in November. This would bring its full-year dividend to £1.42 per share.

Nonetheless, there are risks associated with Imperial. While its stock performance year to date (YTD) is impressive, it may not be able to keep this up when the market starts to recover. But I’m primarily buying shares in the tobacco stock to benefit from its defensive attributes during this inflationary period, and to earn some passive income in both the immediate and long term.

Coated in luxury

Next on my list is Burberry (LSE: BRBY). The British brand is well positioned to take full advantage of the Veblen effect due to the appeal of its luxe products. Despite its YTD share performance stagnating, the company posted a decent set of Q1 numbers a couple of months ago.

Excluding China, the company saw substantial growth in the Americas and EMEIA regions as countries came out of lockdown. This performance can potentially be replicated as China slowly emerges out of lockdown too. Given that approximately half of the firm’s revenue stems from China, this could present a huge tailwind to its sales numbers in the quarters to come.

All that being said, Burberry shares still hold a ‘neutral’ rating with a price target of £19.28. While this doesn’t suggest too much of an upside, these targets haven’t taken that tailwind of China’s reopening and a weaker pound into account. For that reason, I’ll be looking to buy more shares for my portfolio if the price drops below £18.